I spent last weekend in Omaha, Nebraska. That is, of course, the home of Berkshire Hathaway, the company that Warren Buffett (and Charlie Munger) are famous for. I am not a shareholder, but was fortunate to be invited to attend its annual shareholders’ meeting, always held in early May.

Advice I often give is: “Ask for what you want.” Well, while attending an agribusiness seminar a few months ago, I overheard a friend of mine talking about attending the Berkshire Hathaway annual meeting last year. He mentioned that he was invited to attend by our mutual friend, Ejnar (pronounced eye-nar).

That sounded like something really interesting to do. So, at dinner that evening, I arranged to be seated next to Ejnar. And I asked for what I wanted. I half-jokingly said, “I’d like to come to Omaha.” And he, in all seriousness, said, “You are invited! And bring your daughter Alex.” Ejnar owns a private investment firm, and each year invites about 100 business colleagues to Omaha for a day of business presentations and the following day, they all attend the Berkshire Hathaway shareholders’ meeting. He encourages people to bring their children, so they can start to learn, at an early age, about investing and business.

So last weekend, Alex and I flew to Omaha and spent the first day with 100 total strangers from the dairy, grain, and indoor farming industries, plus many financial advisors and investors and more. Two people traveled all the way from Oman (in the Middle East), just to join this meeting. And several attendees came from Europe and Australia, too.

On Saturday morning, we were all up at 6, so we could be at the Century Link Arena when the doors opened at 7. We lined up, along with 40,000 shareholders. It was kind of crazy! We were lucky to get seats in the stadium. You can see from this photo that we’re in the “nosebleed” seats.

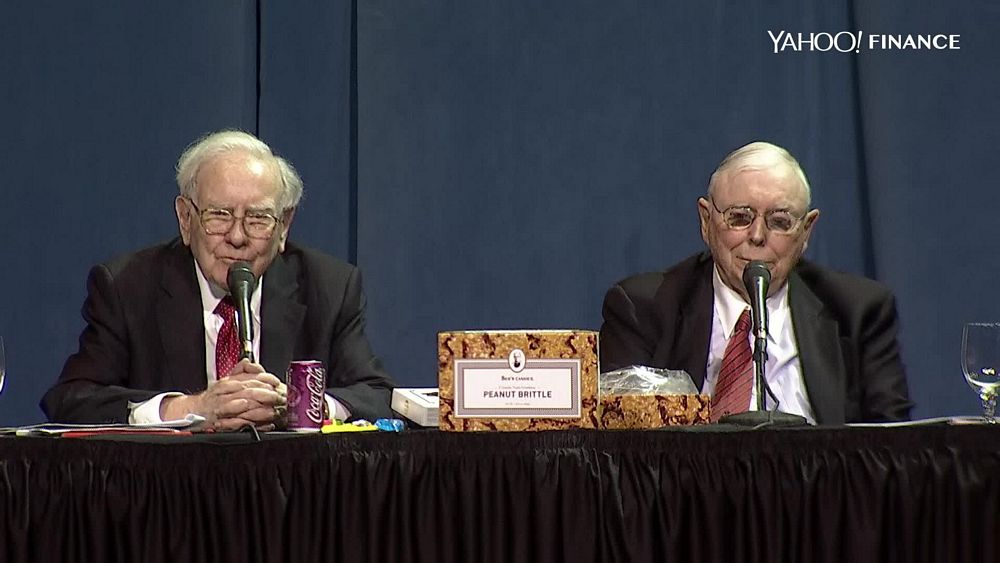

What is so unique about this annual meeting is that Warren Buffett, age 86 (on the left), and Charlie Munger, age 93, sit on the stage and answer questions from the audience from 9 a.m. to 4 p.m. (with an hour break for lunch). They do not know the questions in advance and the questions are from regular folks.

(In case you’re wondering, the box of See’s Candies’ peanut brittle is on the table for two reasons: They own See’s Candies and it is Charlie Munger’s favorite, so he munches on it during the entire meeting.)

You can read the transcript of the annual Berkshire Hathaway (B-H) meeting, but these were some of the high points for me:

- Hundreds, perhaps thousands, of young people (under 20) were in the audience. I met a 24-year-old who attended his first B-H meeting when he was 10! It made me realize that it is never too early to start talking about financial investment decisions and business with your children. And when one of the young folks asked Warren and Charlie a question, they were treated with the same seriousness as those asked by older adults.

- Warren admitted that he is not a tech guy and that he really missed out on many tech stocks, like Amazon. B-H only invests in companies and industries that they understand. It was pretty amazing to hear their honest and authentic answers about their misses. (I don’t think Warren missed much, as his net worth, over $73 billion, is more than Facebook’s Mark Zuckerberg’s).

- They talked about how important culture is in a business they invest in. That’s why they spend so much time studying businesses before they buy an interest. I’ve heard they may only make one new investment a year.

- They have a lot of cash on hand (over $90 billion right now). That tells me they are patient, thorough, and in no rush to invest if they don’t feel ready. How many of us could learn from that?

- When talking about their investment strategy, Charlie said, “Remember, the first rule of fishing is to fish where the fish are. The second rule of fishing is to never forget the first rule.”

- Berkshire Hathaway never misses an opportunity to promote the companies it owns. In the lower level of the arena, a giant trade show displayed products from many B-H companies. You could buy See’s candy (which I did), Fruit of the Loom underwear (with B-H logos), and stickers from Oriental Trading Company, plus get SWAG from Coca-Cola (B-H owns 9.4 percent of the Coca Cola Company, or 400,000,000 shares). No opportunity was missed to highlight their holdings.

Overall, it was a mind-expanding weekend and I hope to be invited back next year. Shares of Berkshire Hathaway stock are $245,000 per share (they have never done a stock split). I was happy to know they have Class B (non-voting) stock that goes for about $160 per share. I think that’s the only way I’m ever going to be a shareholder.

Here I am at the Coca-Cola booth with “Warren Buffett.”

Karen

P.S. Here are the 9 best Warren Buffett quotes from the Berkshire Hathaway annual meeting, from Fortune.